Foreign Direct Investment in Indian Banking Sector: A Study.

It’s easier to prepare for essay topic on banking and finance as topics collide with the ones in economic and finance management for RBI grade B. It is advised to read detailed articles in newspapers and magazines related to banking, economy and finance.Academia.edu is a platform for academics to share research papers.Foreign direct investment in India in infrastructure development projects excluding arms and ammunitions, atomic energy sector, railway system, extraction of coal and lignite and mining industry is allowed upto 100% equity participation with the capping amount as Rs. 1500 crores.

Indian banking sector has created very important platform in the development of economy of India and in forming wealth to the economy. In 2008 when United States of America and world economy got into trouble, the financial sector of India also got affected but only Indian banking sector maintained its business because of the better controlled system and saving habits of Indian middle man.Essay Writing is one of the two questions asked in the descriptive tests of various exams like SBI-PO, IBPS-PO, BOB and many more. A chunk of the essay topics for banking exams include topics related to the banking and economy sectors.

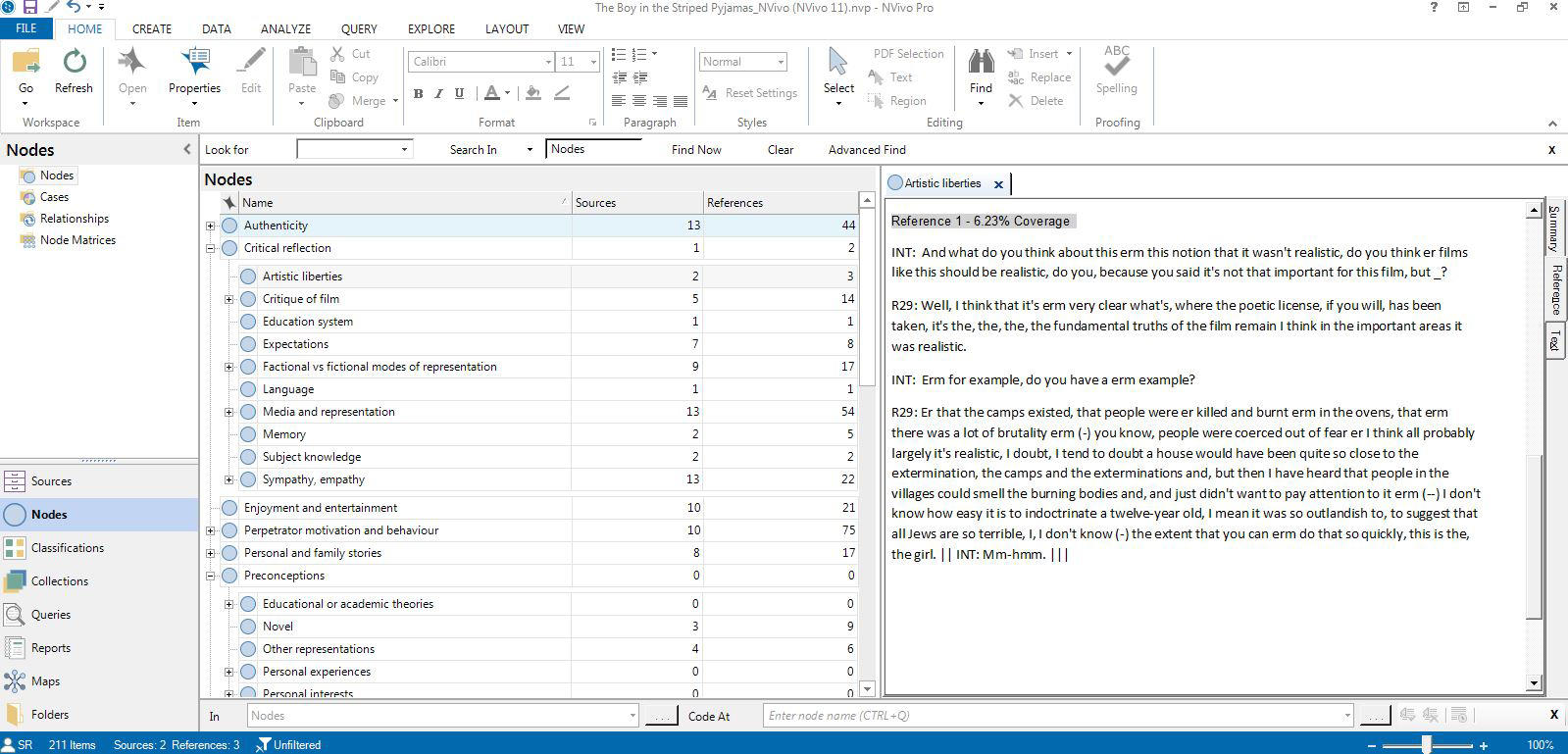

Is this contribution of FDI in this sector is stimulating the economic growth or not, this knowledge thrust of research scholar create the interest in conducting this study. Objectives of study To study the FDI inflows in Indian Service Sector from 1991-2010. To study the relationship between service sector growth and India economy.